Cryptocurrency (especially Bitcoin) has become a popular investment option in recent years, with more and more people looking to buy crypto as a way to diversify their portfolios and generate profits. However, buying and investing in cryptocurrency can be a complex and intimidating process, especially for those who are new to the world of finance and technology. In this blog post, we will go over some essential tips to help you make informed decisions when buying crypto.

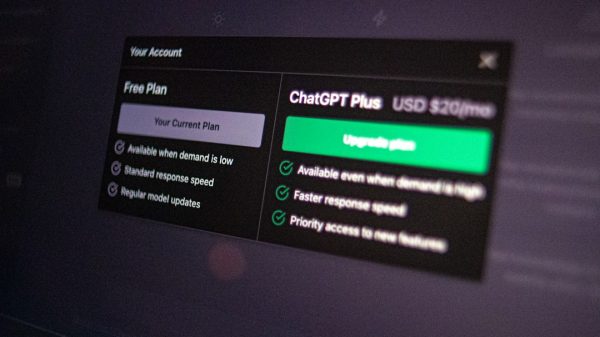

Choose the Right Cryptocurrency Exchange

The first step in buying crypto is to choose a reputable and reliable cryptocurrency exchange. There are many exchanges to choose from, and each one has its own unique features and benefits. Some businesses are designed for beginners, offering simple and user-friendly interfaces, while others are more advanced, offering more trading options and customization. Consider the security of the exchange, the fees, the available cryptocurrencies, and the payment methods it accepts. You can also compare multiple deals and read online reviews to help you make the best decision.

Decentralized and Centralized Exchanges

Another factor to consider when choosing an exchange is whether it is decentralized or centralized. Decentralized exchanges (DEXs) operate on a decentralized network and are not controlled by any central authority. This makes them less vulnerable to hacks or government interference, but they may also have higher fees and slower transaction times. Centralized exchanges, on the other hand, are controlled by a central authority, making them more vulnerable to hacks, but they are also generally easier to use and have lower fees.

Proper Storage for Your Cryptocurrencies

Buy Crypto and then store them in a secure and safe place. One of the best ways to do this is to use a hardware wallet, which is a physical device that stores your private keys offline, making them more secure from hackers. Alternatively, you can store your cryptocurrencies in a software wallet, but it is important to choose one that is reputable and secure. If you’re purchasing mostly one coin, like Bitcoin, then it’s recommended you find a Bitcoin storage solution rather than a catch-all wallet.

Evaluate the Potential of a Cryptocurrency

Before investing in a cryptocurrency, it is essential to evaluate its potential and understand its underlying technology, as well as the market trends and conditions. Consider the project’s overall vision and mission, the development team, the technology behind the cryptocurrency, and the community support it has. You can also look at its historical performance, including its price movements and market capitalization.

Consider the Risks Involved

Cryptocurrency is a highly speculative investment, and as with any investment, there are risks involved. The crypto market is known for its high volatility, and the price of cryptocurrencies can fluctuate rapidly. It is essential to understand the risks involved in buying crypto and to never invest more than you can afford to lose. You should also always have a clear investment strategy and a solid understanding of your risk tolerance.

Diversify Your Portfolio

Another important tip is to diversify your portfolio by investing in a variety of cryptocurrencies, rather than putting all your eggs in one basket. This will help to spread the risk and reduce the impact of any one investment. Consider investing in a mix of large-cap and small-cap cryptocurrencies, as well as a mix of different cryptocurrencies that have different underlying technologies and use cases.

Understand the Tax Implications

Cryptocurrency is subject to tax in most countries, and it is important to understand the tax implications of buying and holding cryptocurrencies. You may be required to report your crypto investments on your tax return and pay taxes on any profits you make. It is always a good idea to consult with a tax professional to ensure you are following the correct procedures and meeting all your tax obligations.